UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

| FORM | |||||

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 25, 2023

PILGRIM'S PRIDE CORPORATION

(Exact Name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

| (Zip Code) | ||||||||||||||

| (Address of principal executive offices) | ||||||||||||||

Registrant's telephone number, including area code: (970 ) 506-8000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of Exchange on Which Registered | ||||||||||||

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Attached hereto as Exhibit 99.1 is an overview of Pilgrim's Pride Corporation to be referenced during the Company's earnings conference call of October 26, 2023.

The information furnished in Item 7.01 and in Exhibit 99.1 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any of Pilgrim's Pride Corporation's filings under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

Exhibit 99.1 Supplemental Historical Financial Information

Exhibit 104 Cover Page Interactive Data File formatted in iXBRL

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PILGRIM’S PRIDE CORPORATION | |||||||||||

| Date: | October 25, 2023 | /s/ Matthew Galvanoni | |||||||||

| Matthew Galvanoni | |||||||||||

| Chief Financial Officer and Chief Accounting Officer | |||||||||||

Pilgrim’s Pride Corporation (NASDAQ: PPC) Financial Results for Third Quarter Ended September 24th, 2023

Cautionary Notes and Forward-Looking Statements ◼ Statements contained in this press release that state the intentions, plans, hopes, beliefs, anticipations, expectations or predictions of the future of Pilgrim’s Pride Corporation and its management are considered forward-looking statements. Without limiting the foregoing, words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “should,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include: the impact of the COVID-19 pandemic, efforts to contain the pandemic and resulting economic downturn on our operations and financial condition, including the risk that our health and safety measures at Pilgrim’s Pride production facilities will not be effective, the risk that we may be unable to prevent the infection of our employees at these facilities, and the risk that we may need to temporarily close one or more of our production facilities; the risk that we may experience decreased production and sales due to the changing demand for food products; the risk that we may face a significant increase in delayed payments from our customers; and additional risks related to COVID-19 set forth in our most recent Form 10-K and Form 10-Q filed with the SEC; matters affecting the poultry industry generally; the ability to execute the Company’s business plan to achieve desired cost savings and profitability; future pricing for feed ingredients and the Company’s products; outbreaks of avian influenza or other diseases, either in Pilgrim’s Pride’s flocks or elsewhere, affecting its ability to conduct its operations and/or demand for its poultry products; contamination of Pilgrim’s Pride’s products, which has previously and can in the future lead to product liability claims and product recalls; exposure to risks related to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate; management of cash resources; restrictions imposed by, and as a result of, Pilgrim’s Pride’s leverage; changes in laws or regulations affecting Pilgrim’s Pride’s operations or the application thereof; new immigration legislation or increased enforcement efforts in connection with existing immigration legislation that cause the costs of doing business to increase, cause Pilgrim’s Pride to change the way in which it does business, or otherwise disrupt its operations; competitive factors and pricing pressures or the loss of one or more of Pilgrim’s Pride’s largest customers; currency exchange rate fluctuations, trade barriers, exchange controls, expropriation and other risks associated with foreign operations; disruptions in international markets and distribution channels, including, but not limited to, the impacts of the Russia-Ukraine conflict; the risk of cyber-attacks, natural disasters, power losses, unauthorized access, telecommunication failures, and other problems on our information systems; and the impact of uncertainties of litigation and other legal matters described in our most recent Form 10-K and Form 10-Q, including the In re Broiler Chicken Antitrust Litigation, as well as other risks described under “Risk Factors” in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and subsequent filings with the Securities and Exchange Commission. The forward- looking statements in this release speak only as of the date hereof, and the Company undertakes no obligation to update any such statement after the date of this release, whether as a result of new information, future developments or otherwise, except as may be required by applicable law. ◼ Actual results could differ materially from those projected in these forward-looking statements as a result of these factors, among others, many of which are beyond our control. In making these statements, we are not undertaking, and specifically decline to undertake, any obligation to address or update each or any factor in future filings or communications regarding our business or results, and we are not undertaking to address how any of these factors may have caused changes to information contained in previous filings or communications. Although we have attempted to list comprehensively these important cautionary risk factors, we must caution investors and others that other factors may in the future prove to be important and affecting our business or results of operations. ◼ This presentation may include information that may be considered non-GAAP financial information as contemplated by SEC Regulation G, Rule 100, including EBITDA, Adjusted EBITDA, LTM EBITDA, Net Debt, Free Cash Flow, Adjusted EBITDA Margin and others. Accordingly, we have provided tables in the accompanying appendix and in our previous filings with the SEC that reconcile these measures to their corresponding GAAP-based measures and explain why these measures are useful to investors, which can be obtained from the Consolidated Statements of Income provided with our previous filings with the SEC. Our method of computation may or may not be comparable to other similarly titled measures used in filings with the SEC by other companies. See the consolidated statements of income and consolidated statements of cash flows included in our financial statements.

Third Quarter 2023 Financial Review Main Indicators ($MM) Q3 2023 Q3 2022 Net Revenue 4,360.2 4,469.0 Gross Profit 345.9 497.3 SG&A 138.6 158.1 Operating Income 206.4 339.2 Net Interest 33.5 34.2 Net Income 121.6 259.0 Earnings Per Share (EPS) 0.51 1.08 Adjusted EBITDA* 324.0 460.5 Adjusted EBITDA Margin* 7.4% 10.3% * This is a non-GAAP measurement considered by management to be useful in understanding our results. Please see the appendix and most recent SEC financial filings for definition of this measurement and reconciliation to US GAAP. In $MM U.S. EU MX Net Revenue 2,488.3 1,312.2 559.7 Adjusted Operating Income* 111.9 43.7 62.2 Adjusted Operating Income Margin* 4.5% 3.3% 11.1% Source: PPC 3 ▪ U.S.: Year-over-year (YoY) decline in commodity market pricing impacted Big Bird business; however, significant quarter-over-quarter (QoQ) operating income improvement for the overall US business; UK/Europe: YoY and QoQ profit improvement due to inflationary cost recovery efforts and product diversification; Mexico: YoY and QoQ profitability increases due to improved balance in supply / demand dynamic and breeder cost reductions. ▪ SG&A lower due to reduction in employee-related costs in the US, decrease in legal settlement costs and other cost efficiencies achieved in the US and UK/Europe. ▪ Q3 2023 Adjusted EBITDA* YoY decrease driven by substantially lower US commodity market pricing; however, continued QoQ improvements in Adjusted EBITDA* due to benefits of our portfolio balance, Key Customer strategy, and geographic diversification.

- 2,000 4,000 6,000 8,000 10,000 12,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Th o u sa n d H e a d 2022 2023 5 Yr. Avg. ▪ Trailing 8-Month placements increased 2.7% vs. year ago. Pullet Placements +6.6% Y/Y in Q3-2023; Up 2.6% YTD Source: USDA Intended Pullet Placements 4

1,500 1,550 1,600 1,650 1,700 1,750 1,800 1,850 1,900 1,950 2,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec E g g s Eggs/100 2022 2023 5 Yr. Avg. Source: USDA ▪ Broiler layer flock +1.3% YoY in Q3-23. ▪ Eggs/100 -0.9% YoY in Q3-23. Broiler Layer Flock Increased Y/Y In Q3; Eggs/100 Below Year Ago level 58,000 59,000 60,000 61,000 62,000 63,000 64,000 65,000 66,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec H e a d ( 0 0 0 ) Broiler Type Hatching Layers 2022 2023 5 Yr. Avg. 5

Egg Sets -2.1% YoY in Q3-23; Hatchability Trended -0.8% Below Q3-22 Levels Source: USDA 6 200,000 205,000 210,000 215,000 220,000 225,000 230,000 235,000 240,000 245,000 250,000 T h o u s a n d s o f E g g s Chicken Egg Sets by Week - USDA 5 Year Range 5 Yr. Avg. 2021 2022 2023 74.0% 75.0% 76.0% 77.0% 78.0% 79.0% 80.0% 81.0% 82.0% 83.0% % Chicken Hatchability by Week - USDA 5 Year Range 5 Yr. Avg. 2021 2022 2023

Source: USDA 7 Broiler Placements Down -2.1% Y/Y in Q3-23 160,000 165,000 170,000 175,000 180,000 185,000 190,000 195,000 200,000 H e a d ( 0 0 0 ) Chicken Broiler Placed by Week- USDA 5 Year Range 5 Yr. Avg. 2021 2022 2023

Source: USDA 8 Increased Head Counts in 4.26-6.25 LBS Segment YTD; Y/Y Reductions in Q3 For 6.26-7.75 LBS Segment 25.5% 25.3% 24.8% 22.7% 21.8% 20.9% 19.7% 17.3% 16.6% 32.2% 31.2% 30.4% 30.2% 28.7% 27.4% 26.2% 27.6% 29.9% 20.9% 22.5% 23.6% 25.4% 26.2% 27.6% 28.4% 29.7% 27.9% 21.4% 20.9% 21.2% 21.7% 23.3% 24.1% 25.7% 25.4% 25.6% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2015 2016 2017 2018 2019 2020 2021 2022 2023 Head Processed by Size <4.25 4.26-6.25 6.26-7.75 >7.75

Source: USDA ▪ Total Inventories in September is below 5-year average. ▪ Breast meat inventories on par with end of Q2 levels. ▪ Wing inventories in September below 5-year average. ▪ Dark meat inventories reduced -17% Y/Y in September driven by fewer LQs which decreased 32% Y/Y. ▪ Other category continues to be large contributor of inventory, more than 40% of total. 9 Industry Cold Storage Supplies Ended Q3 Below Historical Average 500,000 550,000 600,000 650,000 700,000 750,000 800,000 850,000 900,000 950,000 1,000,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec LB S (0 00 ) Total Chicken Inventories 2022 2023 5 Yr. Avg.

Source: PPC, EMI 10 Chicken Pricing Rebounded Briefly Before Ending Quarter In Line With Year Ago Levels 50 70 90 110 130 150 170 1 /6 2 /3 3 /3 3 /3 1 4 /2 8 5 /2 6 6 /2 3 7 /2 1 8 /1 8 9 /1 5 1 0 /1 3 1 1 /1 0 1 2 /8 C e n ts /L b Jumbo Cutout 5 Year Range 5 Yr. Avg. 2021 2022 2023

BSB and Tenders Benefitted From Counter-Seasonal Price Movement in Q3; Wings Improved Steadily Note: On the week of September 2, 2022, USDA revised their reporting of chicken prices from regional prices to one national metric. The old USDA NE Broiler prices previously used provided the largest sample size and the most accurate reflection of the chicken market. The above pricing indicates the new national price reflected by the USDA reporting from 9/2/22 on. 0.00 50.00 100.00 150.00 200.00 250.00 300.00 350.00 400.00 1 /7 2 /6 3 /8 4 /7 5 /7 6 /6 7 /6 8 /5 9 /4 1 0 /4 1 1 /3 1 2 /3 C e n ts /L b USDA Boneless/Skinless Breast 5 Year Range 5 Year Average 2021 2022 2023 15.00 25.00 35.00 45.00 55.00 65.00 1 /7 2 /6 3 /8 4 /7 5 /7 6 /6 7 /6 8 /5 9 /4 1 0 /4 1 1 /3 1 2 /3 C e n ts /L b USDA Leg Quarters 5 Year Range 5 Year Average 2021 2022 2023 0.00 50.00 100.00 150.00 200.00 250.00 300.00 350.00 400.00 1 /7 2 /6 3 /8 4 /7 5 /7 6 /6 7 /6 8 /5 9 /4 1 0 /4 1 1 /3 1 2 /3 C e n ts /L b USDA Whole Wings 5 Year Range 5 Year Average 2021 2022 2023 75.00 125.00 175.00 225.00 275.00 325.00 375.00 1 /7 2 /6 3 /8 4 /7 5 /7 6 /6 7 /6 8 /5 9 /4 1 0 /4 1 1 /3 1 2 /3 C e n ts /L b USDA Tenders 5 Year Range 5 Year Average 2021 2022 2023 11

12 WOG Values Moving Seasonally Source: EMI 60.0 70.0 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 1/ 6 1/ 2 0 2/ 3 2/ 1 7 3/ 3 3/ 1 7 3/ 3 1 4/ 1 4 4/ 2 8 5/ 1 2 5/ 2 6 6/ 9 6/ 2 3 7/ 7 7/ 21 8/ 4 8/ 1 8 9/ 1 9/ 1 5 9/ 2 9 1 0 /1 3 1 0 /2 7 1 1 /1 0 11 /2 4 12 /8 1 2 /2 2 C e n ts /L b . EMI WOG 2.5-4.0 LBS 5 Year Range 5 Yr. Avg. 2021 2022 2023

Corn Dynamics 13 ▪ Historically large planted area contributed to a recovery in US corn ending stocks for the ‘23/24 crop year, despite below-trend yields. Production is forecast at 15.064B bu, the largest since ‘16/17. Ending stocks are forecast at a comfortable 2.111B bu. ▪ The large US production follows a record large Brazilian corn crop that is pricing competitively into global destinations. ▪ Globally, ‘23/24 ending stocks are forecast to increase by 14M metric tons. ▪ South American weather/crop timing, as well as Black Sea export flows, are key factors moving forward. Source: PPC, USDA

Soybean Dynamics 14 ▪ US soybean production is estimated 3.9% lower year-on-year due to lower acreage with similar yields, translating into another year with historically low ending stocks. ▪ Globally, however, last year’s record crop in Brazil continues to price competitively into export markets throughout the balance of their crop year, creating a path for US demand rationing. ▪ Though in the planting stage, both Brazil and Argentina soy crops are expected to be larger year-on-year, boosting global supply. South American weather conditions bear watching. ▪ US crush industry expansion should keep domestic soybean meal markets well supplied. Globally, the forecast rebound in Argentina soybean production could further pressure to soybean meal prices. ▪ Though biofuel policy dependent, soy oil ending stocks likely become more balanced as oil import flows become more diversified and liquid. Source: PPC, USDA

Fiscal Year 2023 Capital Spending ▪ Continued investment in strategic and automation projects will support Key Customers’ growth and emphasize our focus on further diversification of our portfolio and operational improvements Capex (US$M) 15Source: PPC

APPENDIX

Appendix: Reconciliation of Adjusted EBITDA 17 “EBITDA” is defined as the sum of net income plus interest, taxes, depreciation and amortization. “Adjusted EBITDA” is calculated by adding to EBITDA certain items of expense and deducting from EBITDA certain items of income that we believe are not indicative of our ongoing operating performance consisting of: (1) foreign currency transaction losses, (2) costs related to litigation settlements, (3) restructuring activities losses, (4) transaction costs related to acquisitions, (5) property insurance recoveries for Mayfield, Kentucky tornado property damage losses, and (6) net income attributable to noncontrolling interests. EBITDA is presented because it is used by management and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results prepared in conformity with accounting principles generally accepted in the U.S. (“U.S. GAAP”), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how our management analyzes EBITDA applicable to continuing operations. The Company also believes that Adjusted EBITDA, in combination with the Company’s financial results calculated in accordance with U.S. GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and facilitates a more direct comparison of its performance with its competitors. EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP. EBITDA and Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for an analysis of our results as reported under U.S. GAAP. In addition, other companies in our industry may calculate these measures differently limiting their usefulness as a comparative measure. Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with U.S. GAAP. These limitations should be compensated for by relying primarily on our U.S. GAAP results and using EBITDA and Adjusted EBITDA only on a supplemental basis. Source: PPC

Appendix: Reconciliation of Adjusted EBITDA 18 a. Interest expense, net, consists of interest expense less interest income. b. The Company measures the financial statements of its Mexico reportable segment as if the U.S. dollar were the functional currency. Accordingly, we remeasure assets and liabilities, other than nonmonetary assets, of the Mexico reportable segment at current exchange rates. We remeasure nonmonetary assets using the historical exchange rate in effect on the date of each asset’s acquisition. Currency exchange gains or losses resulting from these remeasurements, as well as, from our U.K. and Europe reportable segment are included in the line item Foreign currency transaction losses in the Condensed Consolidated Statements of Income. c. This represents expenses recognized in anticipation of probable settlements in ongoing litigation. d. Restructuring activities losses are primarily related to restructuring initiatives at multiple production facilities throughout our U.K. and Europe reportable segment. e. Transaction costs related to acquisitions includes those charges that are incurred in conjunction with business acquisitions. f. This represents property insurance recoveries for the property damage losses incurred as a result of the tornado in Mayfield, KY in December 2021. PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In thousands) Net income $ 121,567 $ 258,999 $ 188,106 $ 901,580 Add: Interest expense, net(a) 33,530 34,222 112,116 106,346 Income tax expense 44,553 65,749 20,488 253,679 Depreciation and amortization 104,300 98,966 307,414 300,962 EBITDA 303,950 457,936 628,124 1,562,567 Add: Foreign currency transaction losses(b) 8,924 54 43,462 14,348 Litigation settlements(c) 10,500 19,300 34,700 28,282 Restructuring activities losses(d) 940 — 38,684 — Transaction costs related to acquisitions(e) — — — 972 Minus: Property insurance recoveries for Mayfield tornado losses(f) — 16,182 19,086 19,997 Net income attributable to noncontrolling interest 289 647 1,185 674 Adjusted EBITDA $ 324,025 $ 460,461 $ 724,699 $ 1,585,498 Source: PPC

Appendix: Reconciliation of LTM Adjusted EBITDA 19 The summary unaudited consolidated income statement data for the twelve months ended September 24, 2023 (the LTM Period) have been calculated by subtracting the applicable unaudited consolidated income statement data for the nine months ended September 25, 2022 from the sum of (1) the applicable audited consolidated income statement data for the year ended December 25, 2022 and (2) the applicable unaudited consolidated income statement data for the nine months ended September 24, 2023. PILGRIM'S PRIDE CORPORATION Reconciliation of LTM Adjusted EBITDA (Unaudited) Three Months Ended LTM Ended December 25, 2022 March 26, 2023 June 25, 2023 September 24, 2023 September 24, 2023 (In thousands) Net income (loss) $ (155,042) $ 5,631 $ 60,908 $ 121,567 $ 33,064 Add: Interest expense, net 37,298 39,062 39,524 33,530 149,414 Income tax expense (benefit) 25,256 (8,840) (15,225) 44,553 45,744 Depreciation and amortization 102,148 98,257 104,857 104,300 409,562 EBITDA 9,660 134,110 190,064 303,950 637,784 Add: Foreign currency transaction losses 16,469 18,143 16,395 8,924 59,931 Litigation settlements 5,804 11,200 13,000 10,500 40,504 Restructuring activities losses 30,466 8,026 29,718 940 69,150 Transaction costs related to acquisitions (24) — — — (24) Minus: Property insurance recoveries for Mayfield tornado losses (417) 19,086 — — 18,669 Net income (loss) attributable to noncontrolling interest (66) 444 452 289 1,119 Adjusted EBITDA $ 62,858 $ 151,949 $ 248,725 $ 324,025 $ 787,557 Source: PPC

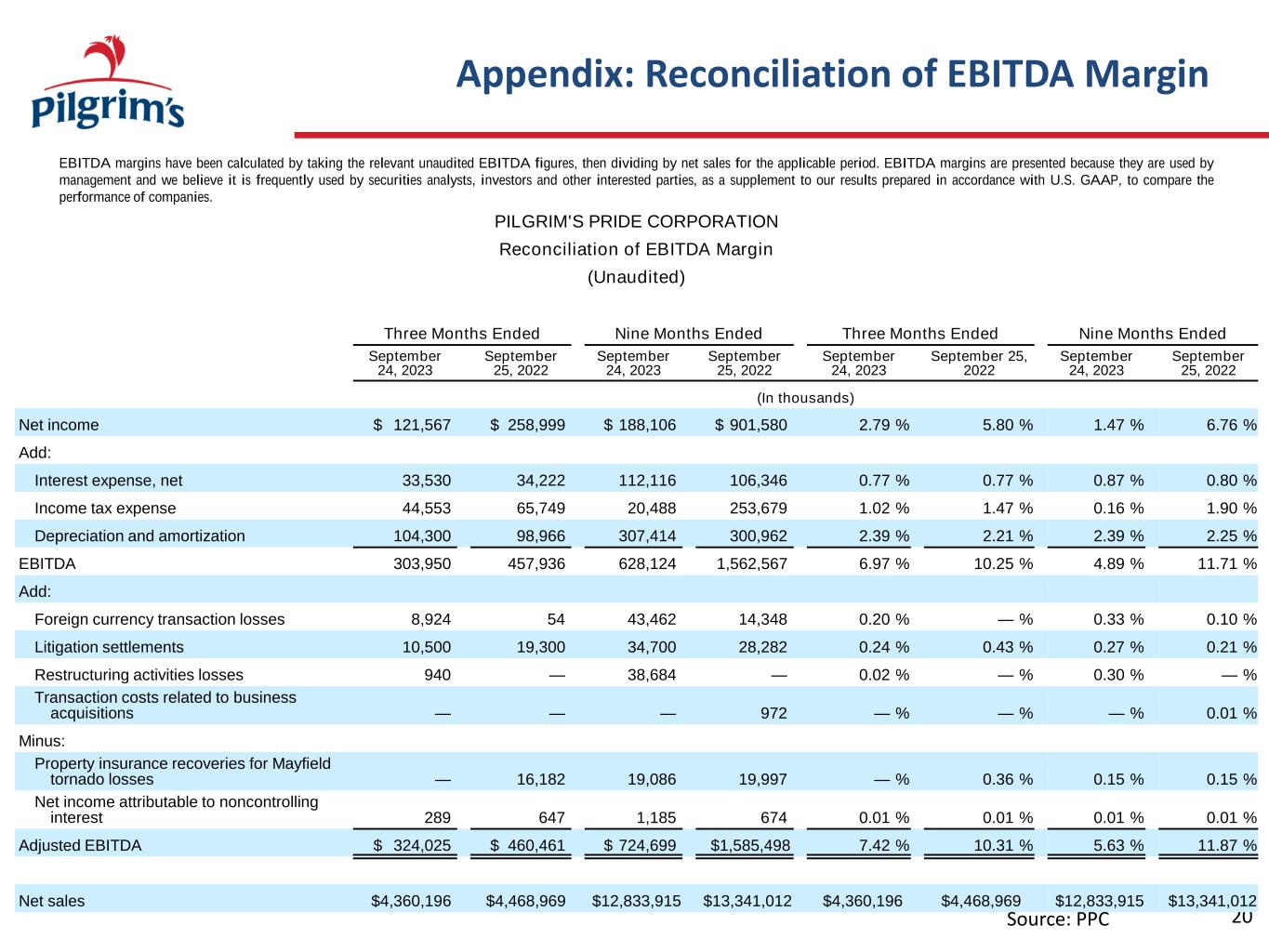

Appendix: Reconciliation of EBITDA Margin 20 EBITDA margins have been calculated by taking the relevant unaudited EBITDA figures, then dividing by net sales for the applicable period. EBITDA margins are presented because they are used by management and we believe it is frequently used by securities analysts, investors and other interested parties, as a supplement to our results prepared in accordance with U.S. GAAP, to compare the performance of companies. PILGRIM'S PRIDE CORPORATION Reconciliation of EBITDA Margin (Unaudited) Three Months Ended Nine Months Ended Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In thousands) Net income $ 121,567 $ 258,999 $ 188,106 $ 901,580 2.79 % 5.80 % 1.47 % 6.76 % Add: Interest expense, net 33,530 34,222 112,116 106,346 0.77 % 0.77 % 0.87 % 0.80 % Income tax expense 44,553 65,749 20,488 253,679 1.02 % 1.47 % 0.16 % 1.90 % Depreciation and amortization 104,300 98,966 307,414 300,962 2.39 % 2.21 % 2.39 % 2.25 % EBITDA 303,950 457,936 628,124 1,562,567 6.97 % 10.25 % 4.89 % 11.71 % Add: Foreign currency transaction losses 8,924 54 43,462 14,348 0.20 % — % 0.33 % 0.10 % Litigation settlements 10,500 19,300 34,700 28,282 0.24 % 0.43 % 0.27 % 0.21 % Restructuring activities losses 940 — 38,684 — 0.02 % — % 0.30 % — % Transaction costs related to business acquisitions — — — 972 — % — % — % 0.01 % Minus: Property insurance recoveries for Mayfield tornado losses — 16,182 19,086 19,997 — % 0.36 % 0.15 % 0.15 % Net income attributable to noncontrolling interest 289 647 1,185 674 0.01 % 0.01 % 0.01 % 0.01 % Adjusted EBITDA $ 324,025 $ 460,461 $ 724,699 $1,585,498 7.42 % 10.31 % 5.63 % 11.87 % Net sales $4,360,196 $4,468,969 $12,833,915 $13,341,012 $4,360,196 $4,468,969 $12,833,915 $13,341,012 Source: PPC

Appendix: Reconciliation of Adjusted EBITDA by Segment 21 a. Interest expense, net, consists of interest expense less interest income. b. The Company measures the financial statements of its Mexico reportable segment as if the U.S. dollar were the functional currency. Accordingly, we remeasure assets and liabilities, other than nonmonetary assets, of the Mexico reportable segment at current exchange rates. We remeasure nonmonetary assets using the historical exchange rate in effect on the date of each asset’s acquisition. Currency exchange gains or losses resulting from these remeasurements, as well as, from our U.K. and Europe reportable segment are included in the line item Foreign currency transaction losses in the Condensed Consolidated Statements of Income. c. This represents expenses recognized in anticipation of probable settlements in ongoing litigation. d. Restructuring activities losses are primarily related to restructuring initiatives at multiple production facilities throughout our U.K. and Europe reportable segment. e. This represents property insurance recoveries for the property damage losses incurred as a result of the tornado in Mayfield, KY in December 2021. PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Three Months Ended Three Months Ended September 24, 2023 September 25, 2022 U.S. U.K. & Europe Mexico Total U.S. U.K. & Europe Mexico Total (In thousands) (In thousands) Net income (loss) $ 31,124 $ 35,743 $ 54,700 $ 121,567 $ 250,744 $ 18,289 $ (10,034) $ 258,999 Add: Interest expense, net(a) 42,331 (649) (8,152) 33,530 34,537 457 (772) 34,222 Income tax expense (benefit) 20,953 5,550 18,050 44,553 68,927 (667) (2,511) 65,749 Depreciation and amortization 63,052 35,927 5,321 104,300 60,868 32,210 5,888 98,966 EBITDA 157,460 76,571 69,919 303,950 415,076 50,289 (7,429) 457,936 Add: Foreign currency transaction losses (gains)(b) 6,168 2,933 (177) 8,924 69 (1,809) 1,794 54 Litigation settlements(c) 10,500 — — 10,500 19,300 — — 19,300 Restructuring activities losses(d) — 940 — 940 — — — — Minus: Property insurance recoveries for Mayfield tornado losses(e) — — — — 16,182 — — 16,182 Net income attributable to noncontrolling interest — — 289 289 — — 647 647 Adjusted EBITDA $ 174,128 $ 80,444 $ 69,453 $ 324,025 $ 418,263 $ 48,480 $ (6,282) $ 460,461 Source: PPC

Appendix: Reconciliation of Adjusted EBITDA by Segment 22 a. Interest expense, net, consists of interest expense less interest income. b. The Company measures the financial statements of its Mexico reportable segment as if the U.S. dollar were the functional currency. Accordingly, we remeasure assets and liabilities, other than nonmonetary assets, of the Mexico reportable segment at current exchange rates. We remeasure nonmonetary assets using the historical exchange rate in effect on the date of each asset’s acquisition. Currency exchange gains or losses resulting from these remeasurements, as well as, from our U.K. and Europe reportable segment are included in the line item Foreign currency transaction losses in the Condensed Consolidated Statements of Income. c. This represents expenses recognized in anticipation of probable settlements in ongoing litigation. d. Restructuring activities losses are primarily related to restructuring initiatives at multiple production facilities throughout our U.K. and Europe reportable segment. e. Transaction costs related to acquisitions includes those charges that are incurred in conjunction with business acquisitions. f. This represents property insurance recoveries for the property damage losses incurred as a result of the tornado in Mayfield, KY in December 2021. PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Nine Months Ended Nine Months Ended September 24, 2023 September 25, 2022 U.S. U.K. & Europe Mexico Total U.S. U.K. & Europe Mexico Total (In thousands) (In thousands) Net income (loss) $ (43,801) $ 68,485 $ 163,422 $ 188,106 $ 793,597 $ 18,551 $ 89,432 $ 901,580 Add: Interest expense, net(a) 127,234 (1,470) (13,648) 112,116 105,847 1,493 (994) 106,346 Income tax expense (benefit) (9,895) 4,743 25,640 20,488 242,342 (12,383) 23,720 253,679 Depreciation and amortization 187,048 103,483 16,883 307,414 181,247 101,475 18,240 300,962 EBITDA 260,586 175,241 192,297 628,124 1,323,033 109,136 130,398 1,562,567 Add: Foreign currency transaction losses (gains)(b) 55,027 835 (12,400) 43,462 18,642 (3,450) (844) 14,348 Litigation settlements(c) 34,700 — — 34,700 28,282 — — 28,282 Restructuring activities losses(d) — 38,684 — 38,684 — — — — Transaction costs related to acquisitions(e) — — — — 847 125 — 972 Minus: Property insurance recoveries for Mayfield tornado losses(f) 19,086 — — 19,086 19,997 — — 19,997 Net income attributable to noncontrolling interest — — 1,185 1,185 — — 674 674 Adjusted EBITDA $ 331,227 $ 214,760 $ 178,712 $ 724,699 $ 1,350,807 $ 105,811 $ 128,880 $ 1,585,498 Source: PPC

Appendix: Reconciliation of Adjusted Operating Income 23 Adjusted Operating Income is calculated by adding to Operating Income certain items of expense and deducting from Operating Income certain items of income. Management believes that presentation of Adjusted Operating Income provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of GAAP operating income to adjusted operating income as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted Operating Income (Unaudited) Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In thousands) GAAP operating income, U.S. operations $ 101,382 $ 338,548 $ 110,541 $ 1,146,821 Litigation settlements 10,500 19,300 34,700 28,282 Transaction costs related to acquisitions — — — 972 Property insurance recoveries for Mayfield tornado losses — (16,182) — (19,997) Adjusted operating income, U.S. operations $ 111,882 $ 341,666 $ 145,241 $ 1,156,078 Adjusted operating income margin, U.S. operations 4.5 % 12.0 % 2.0 % 13.9 % Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In thousands) GAAP operating income, U.K. and Europe operations $ 42,809 $ 14,198 $ 70,583 $ 406 Restructuring activities losses 940 — 38,684 — Adjusted operating income, U.K. and Europe operations $ 43,749 $ 14,198 $ 109,267 $ 406 Adjusted operating income margin, U.K. and Europe operations 3.3 % 1.2 % 2.8 % — % Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In thousands) GAAP operating income (loss), Mexico operations $ 62,182 $ (13,558) $ 157,076 $ 106,850 No adjustments — — — — Adjusted operating income (loss), Mexico operations $ 62,182 $ (13,558) $ 157,076 $ 106,850 Adjusted operating income (loss) margin, Mexico operations 11.1 % (3.2) % 9.8 % 7.7 % Source: PPC

Appendix: Reconciliation of GAAP Operating Income Margin to Adjusted Operating Income Margin 24 Adjusted Operating Income Margin for each of our reportable segments is calculated by dividing Adjusted operating income by Net Sales. Management believes that presentation of Adjusted Operating Income Margin provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of GAAP operating income margin for each of our reportable segments to adjusted operating income margin for each of our reportable segments is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of GAAP Operating Income Margin to Adjusted Operating Income Margin (Unaudited) Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In percent) GAAP operating income margin, U.S. operations 4.1 % 11.9 % 1.5 % 13.8 % Litigation settlements 0.4 % 0.7 % 0.5 % 0.3 % Transaction costs related to acquisitions — % — % — % — % Property insurance recoveries for Mayfield tornado losses — % (0.6) % — % (0.2) % Adjusted operating income margin, U.S. operations 4.5 % 12.0 % 2.0 % 13.9 % Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In percent) GAAP operating income margin, U.K. and Europe operations 3.3 % 1.2 % 1.8 % — % Transaction costs related to acquisitions — % — % — % — % Restructuring activities losses — % — % 1.0 % — % Adjusted operating income margin, U.K. and Europe operations 3.3 % 1.2 % 2.8 % — % Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In percent) GAAP operating income margin, Mexico operations 11.1 % (3.2) % 9.8 % 7.7 % No adjustments — % — % — % — % Adjusted operating income margin, Mexico operations 11.1 % (3.2) % 9.8 % 7.7 % Source: PPC

Appendix: Reconciliation of Adjusted Net Income 25 (a) Net tax expense (benefit) of adjustments represents the tax impact of all adjustments shown above. Adjusted net income attributable to Pilgrim's Pride Corporation (“Pilgrim's”) is calculated by adding to Net income (loss) attributable to Pilgrim's certain items of expense and deducting from Net income (loss) attributable to Pilgrim's certain items of income, as shown below in the table. Adjusted net income attributable to Pilgrim’s Pride Corporation per common diluted share is presented because it is used by management, and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results prepared in conformity with U.S. GAAP, to compare the performance of companies. Management also believe that this non-U.S. GAAP financial measure, in combination with our financial results calculated in accordance with U.S. GAAP, provides investors with additional perspective regarding the impact of such charges on net income attributable to Pilgrim’s Pride Corporation per common diluted share. Adjusted net income attributable to Pilgrim’s Pride Corporation per common diluted share is not a measurement of financial performance under U.S. GAAP, has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of our results as reported under U.S. GAAP. Management believes that presentation of adjusted net income attributable to Pilgrim’s provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of net income (loss) attributable to Pilgrim’s Pride Corporation per common diluted share to adjusted net income attributable to Pilgrim’s Pride Corporation per common diluted share is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted Net Income (Unaudited) Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In thousands, except per share data) Net income attributable to Pilgrim's $ 121,278 $ 258,352 $ 186,921 $ 900,906 Add: Foreign currency transaction losses 8,924 54 43,462 14,348 Litigation settlements 10,500 19,300 34,700 28,282 Restructuring activities losses 940 — 38,684 — Transaction costs related to acquisitions — — — 972 Minus: Property insurance recoveries for Mayfield tornado losses — 16,182 19,086 19,997 Adjusted net income attributable to Pilgrim's before tax impact of adjustments 141,642 261,524 284,681 924,511 Net tax impact of adjustments(a) (4,927) (790) (23,657) (5,880) Adjusted net income attributable to Pilgrim's $ 136,715 $ 260,734 $ 261,024 $ 918,631 Weighted average diluted shares of common stock outstanding 237,347 239,208 237,244 241,494 Adjusted net income attributable to Pilgrim's per common diluted share $ 0.58 $ 1.09 $ 1.10 $ 3.80 Source: PPC

Appendix: Reconciliation of GAAP EPS to Adjusted EPS 26 Adjusted EPS is calculated by dividing the adjusted net income attributable to Pilgrim's stockholders by the weighted average number of diluted shares. Management believes that Adjusted EPS provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of U.S. GAAP to non-U.S. GAAP financial measures is as follows: a. Net tax impact of adjustments represents the tax impact of all adjustments shown above. PILGRIM'S PRIDE CORPORATION Reconciliation of GAAP EPS to Adjusted EPS (Unaudited) Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In thousands, except per share data) GAAP EPS $ 0.51 $ 1.08 $ 0.79 $ 3.73 Add: Foreign currency transaction losses 0.04 — 0.18 0.06 Litigation settlements 0.04 0.08 0.15 0.12 Restructuring activities losses — — 0.16 — Transaction costs related to acquisitions — — — — Minus: Property insurance recoveries for Mayfield tornado losses — 0.07 0.08 0.08 Adjusted EPS before tax impact of adjustments 0.59 1.09 1.20 3.83 Net tax impact of adjustments(a) (0.01) — (0.10) (0.03) Adjusted EPS $ 0.58 $ 1.09 $ 1.10 $ 3.80 Weighted average diluted shares of common stock outstanding 237,347 239,208 237,244 241,494 Source: PPC

Appendix: Supplementary Selected Segment and Geographic Data 27 PILGRIM'S PRIDE CORPORATION Supplementary Selected Segment and Geographic Data (Unaudited) Three Months Ended Nine Months Ended September 24, 2023 September 25, 2022 September 24, 2023 September 25, 2022 (In thousands) Sources of net sales by geographic region of origin: U.S. $ 2,488,317 $ 2,836,920 $ 7,367,093 $ 8,318,007 U.K. and Europe 1,312,205 1,203,095 3,862,219 3,640,129 Mexico 559,674 428,954 1,604,603 1,382,876 Total net sales $ 4,360,196 $ 4,468,969 $ 12,833,915 $ 13,341,012 Sources of cost of sales by geographic region of origin: U.S. $ 2,317,661 $ 2,391,612 $ 7,044,003 $ 6,906,059 U.K. and Europe 1,216,258 1,150,626 3,595,051 3,479,626 Mexico 480,395 429,475 1,397,294 1,239,348 Elimination — (14) 213 (42) Total cost of sales $ 4,014,314 $ 3,971,699 $ 12,036,561 $ 11,624,991 Sources of gross profit by geographic region of origin: U.S. $ 170,656 $ 445,308 $ 323,090 $ 1,411,948 U.K. and Europe 95,947 52,469 267,168 160,503 Mexico 79,279 (521) 207,309 143,528 Elimination — 14 (213) 42 Total gross profit $ 345,882 $ 497,270 $ 797,354 $ 1,716,021 Sources of operating income (loss) by geographic region of U.S. $ 101,382 $ 338,548 $ 110,541 $ 1,146,821 U.K. and Europe 42,809 14,198 70,583 406 Mexico 62,182 (13,558) 157,076 106,850 Elimination — 14 (213) 42 Total operating income $ 206,373 $ 339,202 $ 337,987 $ 1,254,119 Source: PPC